Paul B Insurance for Dummies

Wiki Article

The 4-Minute Rule for Paul B Insurance

Table of ContentsThe Main Principles Of Paul B Insurance Rumored Buzz on Paul B InsuranceHow Paul B Insurance can Save You Time, Stress, and Money.Paul B Insurance - The FactsPaul B Insurance Things To Know Before You Buy8 Easy Facts About Paul B Insurance Shown

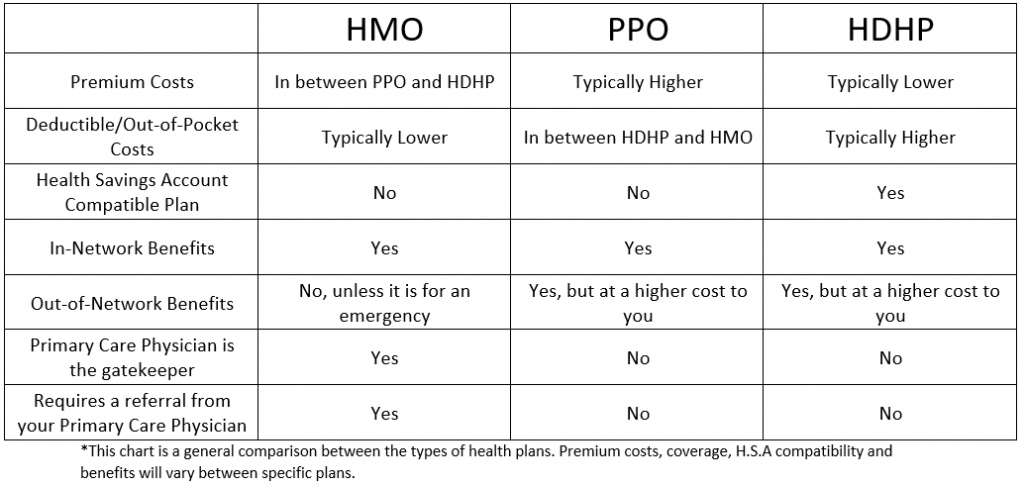

Related Topics One factor insurance policy problems can be so confounding is that the medical care market is constantly altering and the insurance coverage intends used by insurers are hard to classify. In various other words, the lines between HMOs, PPOs, POSs as well as various other kinds of coverage are often blurry. Still, recognizing the makeup of different strategy kinds will be practical in assessing your options.

As soon as the deductible amount is reached, added health and wellness costs are covered in accordance with the arrangements of the medical insurance plan. A staff member might then be accountable for 10% of the prices for treatment received from a PPO network company. Down payments made to an HSA are tax-free to the company and also employee, and cash not spent at the end of the year may be rolled over to pay for future clinical expenditures.

Indicators on Paul B Insurance You Should Know

(Company contributions should be the very same for all staff members.) Employees would be responsible for the first $5,000 in clinical prices, yet they would each have $3,000 in their personal HSA to spend for clinical costs (as well as would have much more if they, as well, added to the HSA). If employees or their family members exhaust their $3,000 HSA slice, they would pay the following $2,000 out of pocket, whereupon the insurance plan would begin to pay.There is no restriction on the amount of cash an employer can add to worker accounts, however, the accounts might not be moneyed through staff member income deferrals under a cafeteria plan. Furthermore, employers are not allowed to refund any kind of component of the balance to workers.

Do you know when the most remarkable time of the year is? The magical time of year when you get to contrast health insurance coverage intends to see which one is best for you! Okay, you got us.

Paul B Insurance Can Be Fun For Everyone

When it's time to select, it's crucial to understand what each plan covers, just how much it sets you back, and also where you can utilize it? This things can really feel complicated, yet it's easier than it seems. We put together some practical knowing steps to help you feel great concerning your choices.(See what we did there?) Emergency care is frequently the exception to the rule. These strategies are the most popular for people that obtain their medical insurance via job, with 47% of covered employees registered in a PPO.2 Pro: Many PPOs have a suitable choice of providers to pick from in your location.

Con: Higher premiums make PPOs a lot more costly than various other sorts of strategies like HMOs. A health care company is a wellness insurance policy plan that usually just covers care from physicians this content that help (or contract with) that certain plan.3 Unless there's an emergency situation, your plan will certainly not pay for out-of-network treatment.

Some Known Details About Paul B Insurance

More like Michael Phelps. It's good to understand that strategies in every group give some kinds of cost-free preventative treatment, and some offer free or discounted healthcare services prior to you meet your deductible.Bronze plans have the least expensive regular monthly premiums but the greatest out-of-pocket expenses. As you work your way up through the Silver, Gold and also Platinum categories, you pay more in premiums, yet much less in deductibles as well as coinsurance. As we mentioned in the past, the extra prices in the Silver category can be decreased if you certify for the cost-sharing reductions.

Paul B Insurance Can Be Fun For Everyone

These job pretty a lot like the various other wellness insurance coverage programs we explained already, but technically they're not a type of insurance coverage.

If you're trying the DIY route and have any sticking around inquiries regarding medical insurance plans, the experts are the ones to ask. As well as they'll do more than just answer your link questionsthey'll additionally discover you the finest cost! Or maybe you 'd such as a method to combine obtaining wonderful medical care protection with the chance to aid others in a time of requirement.

See This Report about Paul B Insurance

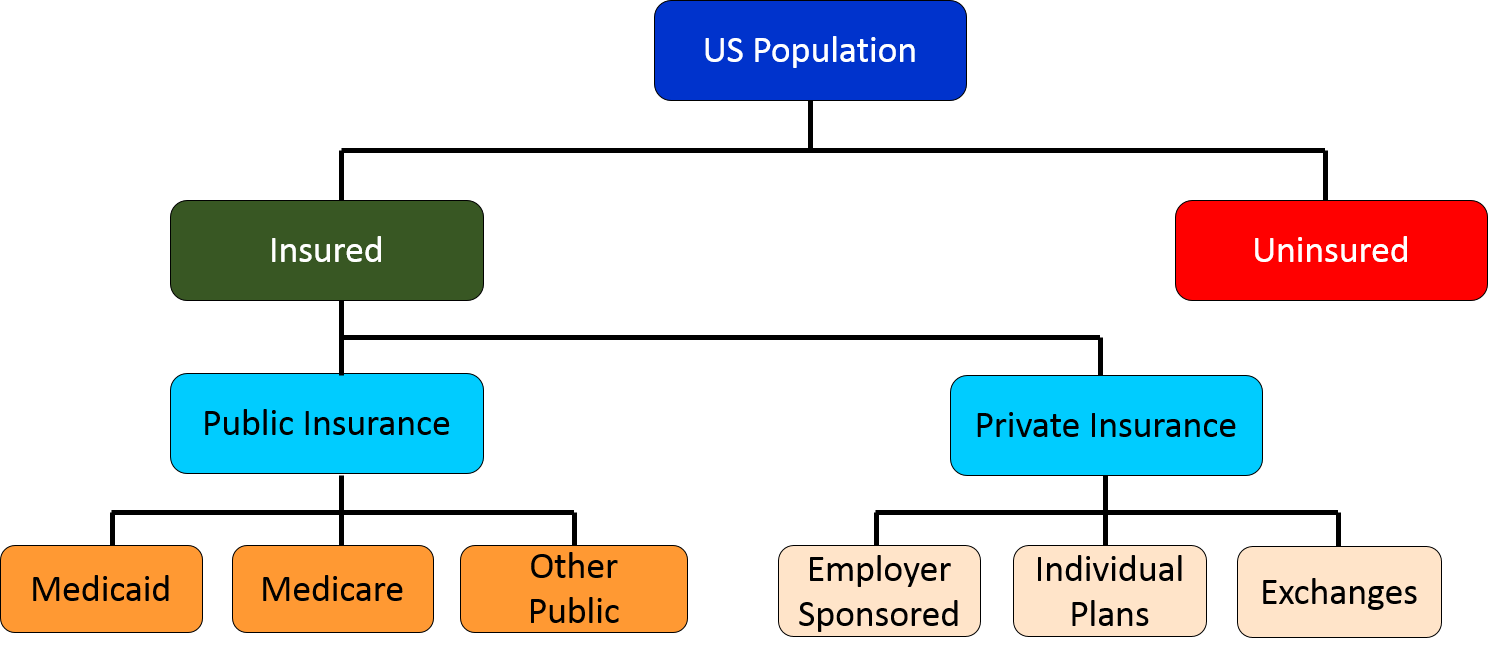

Our relied on partner Christian Health care Ministries (CHM) can help you find out your options. CHM assists family members share healthcare expenses like clinical tests, maternal, hospitalization as well as surgery. Countless individuals in all 50 states have made use of CHM to cover their healthcare needs. Plus, they're a Ramsey, Relied on partner, so you recognize they'll cover the medical bills they're supposed to as well as recognize your protection.Secret Inquiry 2 Among the important things health and wellness care reform has actually carried out in the united state (under the Affordable Treatment Act) is to present even more standardization to insurance plan benefits. Before such standardization, the benefits provided different drastically from plan to plan. For instance, some strategies covered prescriptions, others did not.

Report this wiki page